What is Zakat?

Zakat is one of the five pillars of Islam and an act of worship. The meaning of zakat is “to purify” and so to purify our own wealth all Muslims are obliged to pay a portion of one’s assets to help those in need. Zakat benefits the giver as well as the receiver. Zakat can also be spelled as zakah or zakat.

Where do Zakat payments go?

According to the Qur'an - The poor, The destitute, Administrators/collectors of Zakat, New Muslims facing hardship, To free slaves, Those who are unable to pay their debt, In the path of Allah (swt), and Travellers who cannot afford to return home.

Who pays Zakat?

All Muslim adults who are sane and possess the nisab (a minimum amount of wealth held for a year) should pay Zakat.

How much is the nisab?

Nisab can be determined in terms of gold or silver. The Nisab is 85 grams of Gold. So if your total wealth (Which qualifies for Zakat) is less than the price of 85 grams of Gold, then you do NOT need to pay zakat but if it is higher than the Nisab (85 Grams of Gold) then you MUST pay zakat on the entire amount.

To work out the Nisab at the time of paying your zakat, visit

From the drop down menu, Select your currency ie USD then select 'g' for grams and multiply that figure by 85.

Example USD $57.65 x 85 = USD $4900.25

How much Zakat do I need to pay?

Although there are no specific guidelines in the Holy Qur’an on exact percentages to be given as Zakat, the customary practice is to give 2.5% on capital assets. On agricultural goods, precious metals and livestock, the rate varies between 2.5% and 20%.

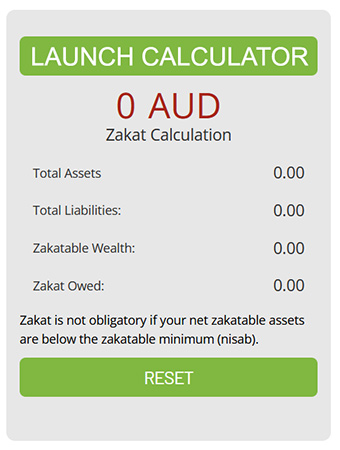

How do I work out how much Zakat to pay?

You don’t have to do lots of complicated maths to work out your Zakat payment, simply use our handy online calculator at the top of this page.

In the above example in US Dollars, if your wealth is less than USD $4900.25 (Check current rate), then you would NOT need to pay zakat but if it is more than USD $4900.25, then you MUST pay 2.5% on the entire amount

What types of wealth are included in Zakat?

Assets that are included in the Zakat calculation are cash, shares, pensions, gold and silver, business goods, crops and cattle and income from investment property.

Personal items such as home, furniture, cars, food and clothing (unless used for business purposes) are not included.

When should I pay Zakat?

Zakat is payable as soon as the nisab (minimum amount of wealth) has been held for a lunar year. If the date of first becoming sahib-un-nisab (owner of wealth equal to or in excess of nisab) is known then use that as your Zakat date, if not, a date may be chosen. Use the same date every year thereafter.

Wealth can fluctuate during the year, going above and below nisab. Zakat is only due if wealth is in excess of nisab at the end of a person’s Zakat year.

What if I miss a Zakat payment?

If Zakat has not been paid in previous years, whether through negligence or ignorance or error, then an honest attempt must be made to calculate the payment owed. This must then be paid as a matter of urgency.

Copyright © Allah's Word. All Rights Reserved. Sitemap